PIPELINE

anticipaged timeline for telomir-1

2025Q1

CMC: Synthesis, Upscaling

& Formulation

Pharmacology: Screening and characterization

ADME: In Vitro Metabolism

Toxicology: Initial

toxicology & General Pharmacology

2025Q2

CMC: Stability, Pharmacology: Characterization & Consolidation

ADME: PK/PD and Formal DMPK

Toxicology: MTD Rat/Dog

2025Q3

CMC: GMP, Stability, Drug product development and Clinical DP development, Pharmacology: Consolidation

ADME: Formal DMPK

Toxicology: Formal Toxicology

Regulatory: Prepare IB and IND

2025Q4IND Submission

market opportunity

Summary of US Epidemiology

The eligible patient pool analysis for Telomir-1 highlights a potential large patient pool looking for potential treatments to their conditions.

| Total Eligible Population | Diagnosed Prevalence | Treatment Rate | Total Addressable Market | |

| Type 2 Diabetes | 34-45M | 25-27M | 88% | $57.47B |

| Cancer | 18M | 1.9M | Nearly 100% | $16.7B |

| Alzheimer’s Disease | 6.5M | 6.5M | 50% | $3.1B |

| AMD | 19.8M | 20M | Variable. Around 20% | $18B |

market opportunity for rare diseases

| Total Eligible Population | Diagnosed Prevalence | Treatment Rate | Total Addressable Market | |

| Progeria (Hutchinson-Gilford Progeria Syndrome) | 20 children in the U.S. | Most cases | Limited, Lonafarnib is the only approved drug | Minimal |

| Wilson’s Disease | 6-10K | Many cases remain undiagnosed. | Includes chelating agents like penicillamine and zinc salts. | $200-900M |

| Friedreich’s Ataxia | 6K | Most cases | SKYCLARYSTM (omaveloxolone) is the first FDA-approved treatment. | $600.5M, projected to reach 1.71B by 2034 |

| Menkes | 16-40 new cases annually | Improved detection through genetic testing | Includes parenteral copper histidinate administration. | Limited |

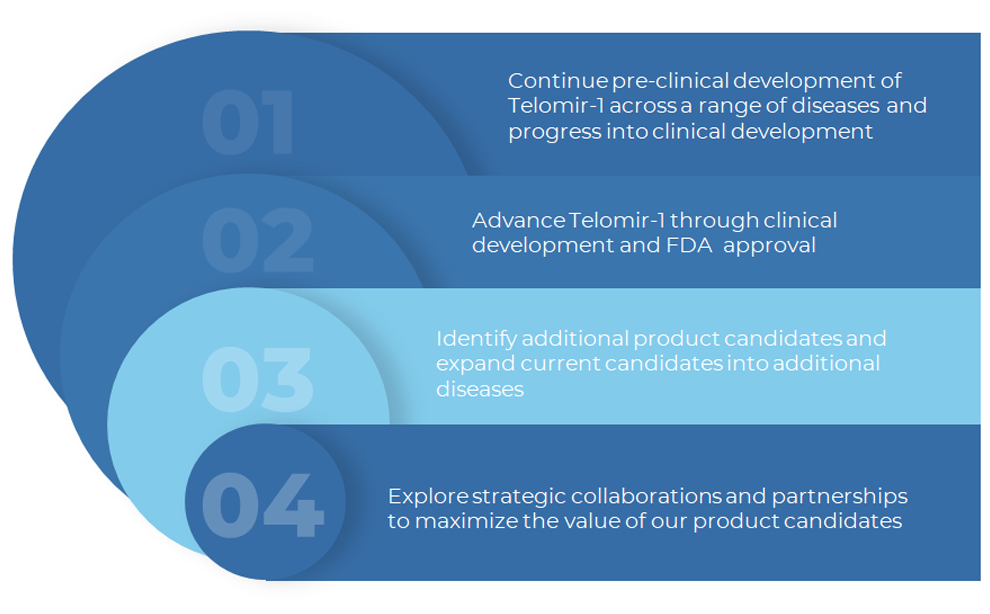

Growth Strategy